1. Introduction to Compound Interest

What is Compound Interest?

Compound interest is the interest on a loan or deposit, calculated based on both the initial principal and the accumulated interest from previous periods. This means that you earn interest on the interest, leading to exponential growth over time. Understanding this concept is crucial for making informed financial decisions.

The Importance of Understanding Compound Interest

Understanding compound interest is essential because it can significantly impact your savings, investments, and debt repayment strategies. Knowing how compound interest works allows you to maximize your earnings on savings and investments while minimizing the costs associated with loans and credit.

Simple vs. Compound Interest: What's the Difference?

Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal plus any accumulated interest. For example, with simple interest, you might earn $50 each year on a $1,000 deposit at a 5% interest rate. With compound interest, the amount you earn each year increases as the interest from previous years is added to the principal.

2. The Math Behind Compound Interest

The Compound Interest Formula Explained

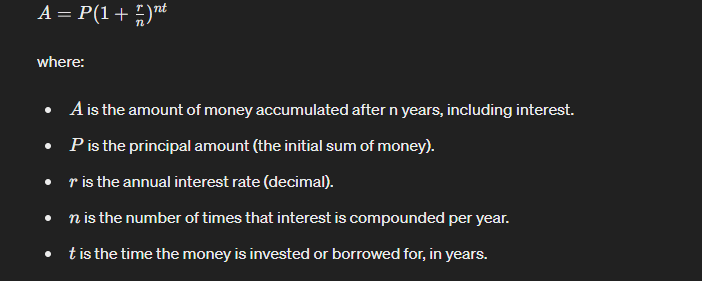

The compound interest formula is:

How Compound Interest is Calculated: Step-by-Step Guide

- Determine the principal amount (P).

- Identify the annual interest rate (r).

- Decide how often interest is compounded per year (n).

- Choose the number of years the money is invested or borrowed (t).

- Plug these values into the compound interest formula.

- Solve the equation to find the accumulated amount (A).

Real-Life Examples of Compound Interest Calculations

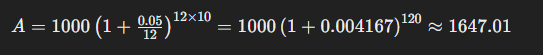

If you invest $1,000 at an annual interest rate of 5%, compounded monthly for 10 years, the calculation would be:

After 10 years, your $1,000 investment would grow to approximately $1,647.01.

3. Benefits of Using a Compound Interest Calculator

Why You Need a Compound Interest Calculator

A compound interest calculator simplifies the process of determining how much your investments will grow over time. It eliminates the need for manual calculations and helps you make more accurate financial projections.

Advantages of Digital Calculators Over Manual Calculations

Digital calculators are fast, efficient, and less prone to errors compared to manual calculations. They can handle complex formulas and multiple compounding periods with ease, providing instant results.

Accuracy and Efficiency: How Calculators Save Time

Using a compound interest calculator saves time by quickly processing the required mathematical operations. This ensures accuracy and allows you to explore different scenarios effortlessly.

4. How to Use a Compound Interest Calculator

Step-by-Step Guide to Using a Compound Interest Calculator

- Enter the principal amount.

- Input the annual interest rate.

- Select the compounding frequency (e.g., monthly, quarterly, annually).

- Specify the investment period in years.

- Click the calculate button to see the results.

Common Inputs and Outputs Explained

Inputs typically include the principal, interest rate, compounding frequency, and time period. Outputs show the accumulated amount, total interest earned, and sometimes a detailed breakdown of interest earned per period.

Tips for Getting the Most Accurate Results

Ensure you enter accurate data, select the correct compounding frequency, and double-check your inputs. Using consistent units for time and rate is crucial for accurate calculations.

5. Types of Compound Interest Calculators

Online vs. Offline Calculators: Which is Better?

Online calculators are convenient and often come with additional features like graphs and comparison tools. Offline calculators can be useful if you need to perform calculations without internet access.

Mobile Apps for Compound Interest Calculations

Many mobile apps offer compound interest calculations along with other financial tools. Apps provide the flexibility to calculate on the go and often include user-friendly interfaces.

Specialized Calculators for Different Financial Goals

Some calculators are designed for specific purposes, such as retirement planning, mortgage calculations, or savings growth. These specialized tools provide more tailored results for your financial goals.

6. Practical Applications of Compound Interest

How Compound Interest Affects Your Savings Account

Compound interest can significantly boost your savings over time. Regular deposits into a high-interest savings account can accumulate substantial wealth due to the compounding effect.

Investing with Compound Interest: Building Wealth Over Time

Investing in stocks, bonds, or mutual funds that offer compound interest can accelerate your wealth-building efforts. Reinvesting dividends and interest payments leads to exponential growth.

The Role of Compound Interest in Loans and Mortgages

Compound interest works against you when it comes to loans and mortgages. Understanding how it accumulates can help you manage debt more effectively and minimize interest payments.

7. Tools and Resources for Compound Interest Calculations

Top 5 Online Compound Interest Calculators

- Calculator.net

- Investopedia’s Compound Interest Calculator

- Bankrate’s Compound Interest Calculator

- TheCalculatorSite.com

- MoneyChimp’s Compound Interest Calculator

Recommended Mobile Apps for Financial Planning

- Compound Interest Calculator by Financial Calculators

- Easy Compound Interest Calculator by Andrei

- Compound Interest Calculator by Loan and Finance

Books and Courses to Learn More About Compound Interest

- “The Compound Effect” by Darren Hardy

- “Rich Dad Poor Dad” by Robert T. Kiyosaki

- Online courses on Khan Academy and Coursera

8. Common Mistakes to Avoid

Pitfalls in Compound Interest Calculations

Avoiding mistakes like incorrect compounding frequency, miscalculating the interest rate, and overlooking additional contributions or withdrawals is crucial for accurate results.

Misunderstanding Compounding Periods

Compounding periods greatly affect the final amount. Ensure you understand whether interest is compounded monthly, quarterly, or annually, as this can change your calculations significantly.

Incorrect Data Entry: Ensuring Accuracy

Double-check all entries for accuracy. Small errors in input data can lead to significant discrepancies in the final output. Always review your inputs before calculating.

9. FAQs About Compound Interest and Calculators

What is the Best Compound Interest Calculator?

The best calculator depends on your needs. Online calculators like those on Calculator.net and Investopedia are highly rated for their ease of use and accuracy.

How Often Should I Use a Compound Interest Calculator?

Use a compound interest calculator whenever you are making financial decisions involving savings, investments, or loans. Regular use can help you stay on track with your financial goals.

Can Compound Interest Calculators Help with Retirement Planning?

Yes, they are valuable tools for retirement planning. By projecting the growth of your retirement savings, you can make more informed decisions about contributions and investment strategies.

10. Conclusion

Recap: The Power of Compound Interest

Compound interest is a powerful financial concept that can significantly enhance your savings and investment growth over time. Understanding and leveraging it effectively is key to achieving your financial goals.

Encouragement to Use Compound Interest Calculators Regularly

Regular use of compound interest calculators can help you make better financial decisions, plan for the future, and maximize your returns. These tools are essential for anyone looking to harness the power of compound interest.

Final Thoughts and Call to Action

Embrace the power of compound interest by using calculators to guide your financial planning. Start today to see how small, consistent efforts can lead to substantial financial growth over time.

Important Links

The Ultimate Guide to Passive Income: Earn Money While You Sleep

What is Passive Income? An Introduction for Beginners It is income that requires minimal active effort to maintain once it’s set up. It’s often described as “earning while you sleep,” and includes revenue streams like investments, royalties, or rent from properties. Unlike active income from a job, passive income allows

Car Insurance: Everything You Need to Know About in 2024

Introduction to Car Insurance: What You Need to Know Car insurance is a financial safety net that protects you against the high costs of accidents, theft, or damage to your vehicle. It is a contract between you and the insurance company, where you pay premiums in exchange for coverage. Understanding

Saving Money: Your Ultimate Guide to Financial Freedom in 24

Introduction to Saving Money: Why It Matters Saving money is a vital skill that impacts not only your present lifestyle but also your future stability. By setting aside a portion of your income, you create a safety net that helps you handle emergencies, achieve financial goals, and even enjoy a

Investing Basics: A Comprehensive Guide for Beginners

Investing Basics: A Beginner’s Guide Investing bsics is the act of putting your money into financial products, like stocks or bonds, or tangible assets like real estate, with the goal of growing your wealth over time. Yahoo Finance provides resources and tools for new investors to understand the basics and

Tesla Stock: Navigating the Future A Deep Dive in 2024

Introduction to Tesla Stock: Why It’s in the Spotlight Tesla stock has captured investor attention globally, thanks to Tesla’s innovations in electric vehicles, autonomous driving, and clean energy solutions. The brand’s ambitious goals and the dynamic leadership of Elon Musk continue to drive interest and impact Tesla stock in significant

Shares: A Comprehensive Guide

What Are Shares? A Beginner’s Guide It represent ownership in a company, giving shareholders a stake in the company’s assets and earnings. When you buy shares, you become part-owner of that company. Shares are fundamental to the stock market, making them a popular tool for individuals aiming to grow their